How to Finance Your Resilient Rebuild

A guide to building and financing a safer, more insurable home after a disaster.

Key Takeaways

Rebuilding a safer, more fire-resistant home is less expensive than many realize.

Building to the IBHS Wildfire Prepared Home Plus standard improves insurability, unlocks insurance premium discounts, and mitigates risk for entire communities.

New financing programs and opportunities exist to help homeowners pay for the costs of rebuilding a safer home.

Rebuilding after a wildfire requires tough decisions, especially when it comes to cost. But creating a home better equipped to withstand disasters is more affordable than most people realize.

In a 2025 study, Headwaters Economics analyzed reconstruction costs for a representative home in Altadena—1,750 square feet, one story—and found that fortifying it against wildfire added only 3% to total construction costs, an incremental $10,000 to $15,000.

Still, homeowners may wonder what, exactly, that added expense buys them, as well as the factors that will determine exactly how much it will cost.

In this article, we cover the key questions that often arise during the rebuilding process:

What are the primary building standards today?

How do people traditionally finance rebuild projects?

What options are available to help finance a more fire-safe rebuild?

Resilient Building Standards: What’s Involved and What it Costs

The normal course of business is to rebuild to code. This is what insurance policies cover and what architects and builders use to guide designs. Current residential building codes are set by state and local governments. They are a minimum building safety standard for new construction and don’t necessarily reflect current or future climate risk in a given region. That’s true in the Los Angeles Basin, even though most homes need additional hardening to withstand the realities of extreme heat and increasingly frequent, intense wildfires.

Enter rebuilding with resilience. Building to fire-resilient standards means using construction materials and strategies that improve a home’s odds of surviving a fire. The Insurance Institute for Business & Home Safety’s (IBHS) Wildfire Prepared Home (WPH) program is one such standard.

Through the WPH program, homeowners can pursue one of two designations: the Wildfire Prepared Home Base standard or the Wildfire Prepared Home Plus standard, which offers the highest degree of protection available in construction today.

Building to the WPH standards requires a greater upfront investment than rebuilding to existing codes and retrofitting later, but it is also easiest to achieve when starting from the ground up. Meeting Plus or Base involves making and installing fire-safe choices, such as:

A fire-rated, Class A roof

Noncombustible gutters and gutter covers

Tempered windows

Fire-proof doors

Noncombustible siding and decking

It also requires prioritizing defensible space around the home, calling for thoughtfully distributed planting throughout the yard as well as hardscaping with gravel and stone to create fuel breaks. Meeting WPH requires the creation of a five-foot buffer zone (“Zone Zero”) immediately surrounding the home, which must be kept free from vegetation and flammable materials.

Achieving the Plus designation requires homeowners to take additional steps, increasing cost but also wildfire resilience.

Install dual tempered paned windows

Non-combustible decking

Locate accessory structures—e.g., playsets, sheds, gazebos—away from the home (current requirement is 30 feet)

Cover gutters and enclose eaves

For those unfamiliar with the benefits of standards like WPH’s Base and Plus standards, the additional cost and steps may seem overwhelming, and it can appear easier to simply stick to the minimum code requirements and retrofit a home later. But minimum codes are just that—minimums—they don’t necessarily reflect current or future climate risk. Rebuilding with fire safety in mind minimizes the risk of losing a home (again) to wildfire, ensuring a future home is better prepared to survive future disasters.

To better understand the differences between CA WUI Part 7, the WPH Base standard, and the WPH Plus standard, view the chart on this page.

Rebuilding is the Right Time to Prepare for the Next Fire

Creating a safer, more fire-resilient home is actually less expensive than retrofitting further down the road. According to Headwaters Economics, retrofitting an entire home to the highest fire safety standard can cost more than $100,000.

When building from the ground up, there’s no pre-existing infrastructure to remove or demolish, which often makes for a more straightforward, less disruptive process. As the homeowner is pulling permits, hiring contractors, and making material selections, installing fire-resistant features can slot easily into the construction timeline.

The Return on Investment to Rebuild to Resilient Standards

Rebuilding with resilience doesn’t just improve a home’s safety; it also translates to ongoing savings. While homeowners are responsible for the costs they incur to rebuild above code to fire resilience standards, such as IBHS’s WPH, some are eligible for insurance premium discounts that lower their monthly insurance bills.

California insurers must now provide premium discounts for fire-resistant construction, which range from a few percentage points to more than 40%, depending on the insurer and the resilience standards adopted. These features can also improve insurability and reduce the chances of insurance rates escalating over time.

The more people who build wildfire-resistant homes, the less likely insurers are to pay claims for wildfire damage, and the lower the odds they’ll have to raise rates to compensate. In fact, resilient building dramatically reduces the likelihood of future losses, per home and per neighborhood. Headwaters Economics finds that every $1 spent on rebuilding communities to be wildfire-resistant can save up to $210 in future damages. Zooming out, that means wildfire-resistant construction in L.A. could avoid up to $43 billion in future economic losses.

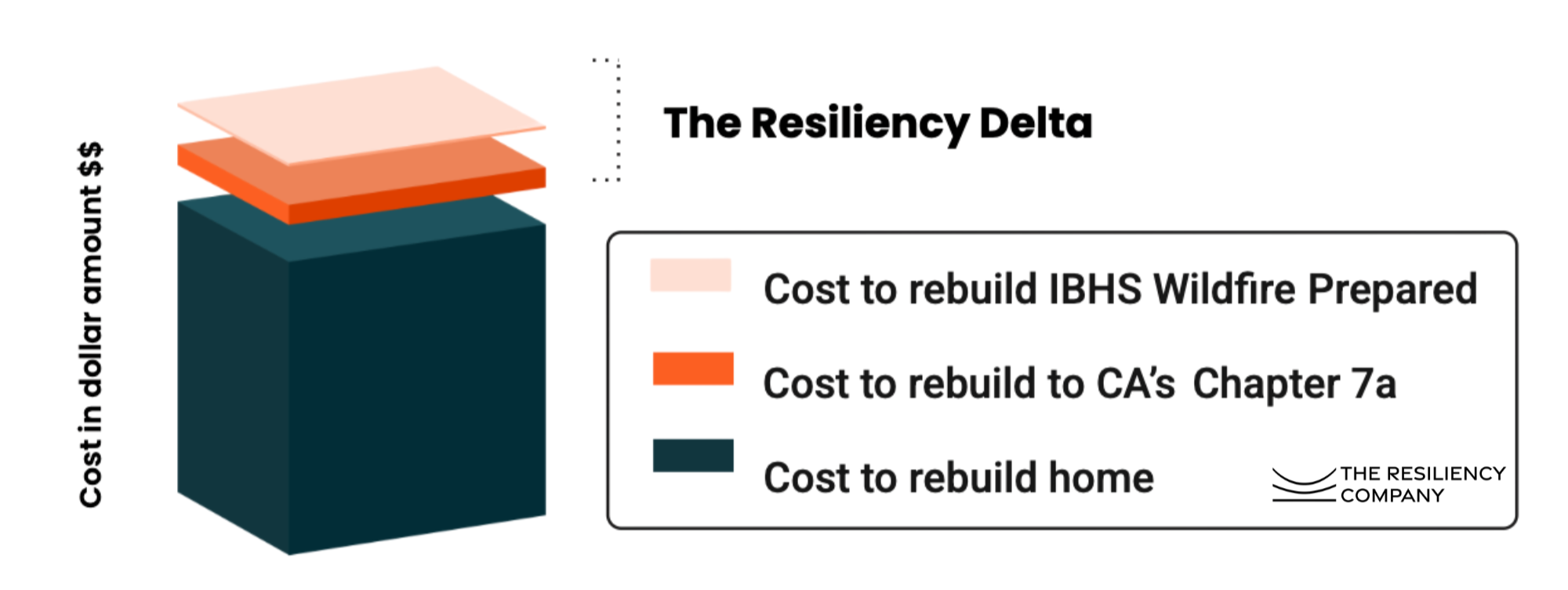

There is a financing gap to rebuild with resilience

Traditional rebuilding assistance—whether from insurers or federal aid—typically covers rebuilding to code, but not beyond it. As a result, there’s a funding gap for the added protections that make homes resilient. We call this gap the “Resiliency Delta.”

Most homeowners cover this cost difference by either paying out of pocket or exploring loan options, like extending a construction loan or using a home equity line of credit, for the additional 3% it takes to meet one of the WPH designations.

Of course, these two options won’t be feasible for many homeowners, but new financing pathways have emerged specifically to help Angelenos protect their properties over time.

New Ways to Pay for Resilience

Multiple programs exist to help homeowners rebuild or upgrade to safer standards.

For rebuilding financial support:

SBA Disaster Loans with Mitigation Add-Ons: SBA offers low-interest disaster loans to homeowners up to $500,000—and borrowers can increase those by up to 20% to make building upgrades that help protect their homes against future disasters.

The Resilient LA Delta Fund: We’ve created a fund to help homeowners rebuild to the highest studied resilience standards and preserve insurability. Ultimately, we aim for it to be available to any L.A. resident impacted by the fires.

New Lending Products and Programs: Mortgage lenders like Bank of America have launched solutions aimed at helping homeowners build back to more resilient standards.

For retrofitting financial support:

California Safe Homes Act (AB 888): A new statewide grant program will provide funding to replace roofs, cover material upgrades, and create defensible space. These grants will be available to homeowners in the “high” or “very high” fire hazard severity zones.

Property Assessed Clean Energy (PACE) Loan: Normally, for energy-efficiency upgrades, PACE financing options are repaid via property taxes over time. Many cities in L.A. County have voted to allow homeowners to access PACE financing for wildfire hardening and resilience.

Finding the option that fits

The rebuilding process can be complicated. To simplify the experience, start here:

Research fire-resistant building standards. We’ve put together a guide to fire-safe construction and different standards here.

Get itemized bids from contractors. Ask them to separate standard materials from non-combustible alternatives to clarify the material cost differences.

Review any insurance settlements carefully. To calculate the gap between payout and actual reconstruction costs.

Get input from the insurance company before finalizing plans. Confirm which features will reduce premiums and get that commitment in writing.

Connect with the PILLAR Program. Our new initiative helps homeowners navigate the journey to rebuilding a fire-safe home, identifying funding opportunities along the way.

The homes rising from the ashes of the Eaton and Palisades fires will shape the L.A. community in decades to come. Resilience strategies help safeguard that future.

Learn more about resilient rebuilding, get a personalized estimate, and connect with funding at buildwithpillar.com.